This project is part of a virtual internship by Codebasics.

As a BootCamp students, we are provided with a 1-month virtual internship by Codebasics and this is the last and final task that we are required to submit.

About The Task

As a Data Analyst, I have to provide insights to the client who is a Business Analyst in an insurance company called Sheild Insurance.

Shield Insurance

Shield Insurance is an insurance company which sells its policies in 5 cities of India.

- Delhi NCR

- Mumbai

- Hyderabad

- Chennai

- Indore

The company offers 8 Insurance policies:

| Policy ID | Premium |

| POL4321HEL | 5000 |

| POL4331HEL | 7500 |

| POL3309HEL | 12000 |

| POL5319HEL | 16700 |

| POL6303HEL | 21500 |

| POL6093HEL | 31700 |

| POL9221HEL | 42500 |

| POL1048HEL | 76500 |

| POL2005HEL | 12000 |

The customer’s age starts from 18 years old and above.

The company has 2 sales modes with 2 categories in each mode.

Offline Mode

- Sales Agent

- Direct Sale

Online Mode

- Application

- Website

The client wants to:

- See the revenue trend and customer acquisition trend over the months.

- See daily revenue and customer growth

- Monitor the policies’ performance

- Age group segmentation

- And appropriate filters to drill down the analysis.

This needs to be presented in a recorded presentation to the client.

Solution

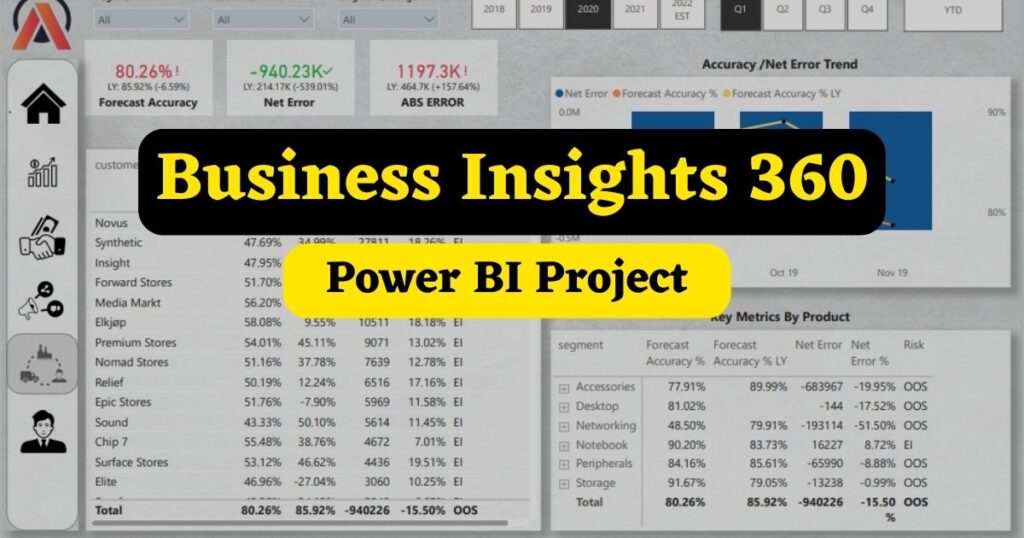

Interactive Dashboard

I haven’t mentioned the company details in the presentation as the presentation is meant to be shared with the company stakeholders to present the insights they asked for.

Presentation

Key Findings

After going through the data and creating the Power BI report I analysed and found that the most profitable month for the company is March 2023.

March is the most successful month in terms of generating revenue and also in acquiring customers.

The total revenue generated in March is 263.8M.

The total number of customers acquired in March is 7081.

The possible reason can be the financial year ending in March.

In India, the financial year ends in March and this event impacts the performance of all the financial institutions and also of the sales executives.

Logic Behind Finacial Year:

- People opt for tax-saving policies in March and buying insurance is one of them.

- Insurance agents also become very active in selling policies and hence Offline Agent sales mode has the highest number of sales.

- The highest-selling policy is the basic one with a Rs.5000 premium. People do not think about the settlement money instead they make real-time decisions to save the tax.

Key Insights

The highest revenue-generating month is March.

The highest customer acquisition happened in March.

The City with the highest number of customers and highest revenue is Delhi NCR.

The age group with the highest revenue and highest number of customers is 31-40 years.

The most successful sales mode for revenue and customer acquisition is the Offline-Agent mode.

The highest settlement expected is by the age group of 65 and above.

The top-selling Policy is POL4321HL with a Base Premium of Rs.5000.

Tools Used:

- Ms Excel

- Power BI

- Canva

- WordPress

- YouTube